All Categories

Featured

Table of Contents

The inquirer represents a customer who was a complainant in an injury issue that the inquirer decided on behalf of this complainant. The accuseds insurer accepted pay the plaintiff $500,000 in an organized settlement that needs it to purchase an annuity on which the complainant will certainly be detailed as the payee.

The life insurance company releasing the annuity is a qualified life insurance business in New York State. N.Y. Ins.

annuity contracts,. released by life insurance companies, based on specific constraints, versus failing in the efficiency of legal responsibilities due to the impairment of insolvency of the insurance firm releasing such. contracts." N.Y. Ins. Legislation 7703 (McKinney 2002) states in the pertinent component that" [t] his post will use to.

N.Y. Ins. The Department has actually reasoned that an annuitant is the holder of the basic right provided under an annuity agreement and stated that ". NY General Guidance Viewpoint 5-1-96; NY General Advise Point Of View 6-2-95.

Annuity Pricing

Although the proprietor of the annuity is a Massachusetts firm, the intended beneficiary and payee is a local of New york city State. Considering that the above mentioned purpose of Article 77, which is to be liberally construed, is to secure payees of annuity contracts, the payee would be shielded by The Life Insurance Coverage Business Warranty Corporation of New York City.

* An instant annuity will not have a buildup phase. Variable annuities released by Safety Life Insurance Company (PLICO) Nashville, TN, in all states except New York and in New York by Protective Life & Annuity Insurance Business (PLAIC), Birmingham, AL.

Annuity Pension Plans

Financiers must very carefully consider the investment goals, risks, charges and expenditures of a variable annuity and the underlying financial investment options prior to investing. An indexed annuity is not an investment in an index, is not a protection or stock market financial investment and does not take part in any type of supply or equity investments.

The term can be three years, 5 years, 10 years or any kind of number of years in between. A MYGA works by linking up a lump sum of money to enable it to accumulate interest.

Top Annuities Companies

If you choose to restore the contract, the interest price might differ from the one you had actually originally concurred to. Because passion rates are established by insurance policy firms that sell annuities, it's essential to do your study before signing a contract.

They can delay their taxes while still used and not looking for additional taxable earnings. Provided the current high rate of interest prices, MYGA has actually come to be a significant component of retirement monetary planning - annuity purchase rate. With the likelihood of rates of interest decreases, the fixed-rate nature of MYGA for a set variety of years is highly appealing to my clients

MYGA prices are typically higher than CD prices, and they are tax deferred which additionally boosts their return. A contract with more restricting withdrawal provisions may have higher rates. Many annuity suppliers deal penalty-free withdrawal arrangements that permit you to take out several of the cash from an annuity before the abandonment duration ends without needing to pay charges.

In my opinion, Claims Paying Capability of the service provider is where you base it. You can glimpse at the state guaranty fund if you want to, however remember, the annuity mafia is viewing.

They know that when they place their cash in an annuity of any kind, the firm is mosting likely to support the insurance claim, and the market is looking after that also. Are annuities guaranteed? Yeah, they are. In my opinion, they're secure, and you ought to enter into them checking out each provider with confidence.

If I placed a recommendation before you, I'm also putting my license on the line as well - deferred annuity meaning. Bear in mind that. I'm extremely positive when I placed something before you when we chat on the phone. That doesn't suggest you need to take it. You might claim, "Yes, Stan, you claimed to buy this A-rated company, yet I really feel much better with A dual and also." Penalty.

1 Million Annuity Payout

I absolutely comprehend that. Bear in mind, we're either weding them or dating them. Then we have the Claims Paying Capacity of the provider, the state warranty fund, and my good friends, that are unknown, that are circling with the annuity mafia. How about that for a solution? That's an accurate solution of a person that's been doing it for a really, long time, and that is that a person? Stan The Annuity Man.

Individuals typically get annuities to have a retired life revenue or to build financial savings for an additional purpose. You can get an annuity from an accredited life insurance coverage representative, insurance provider, economic coordinator, or broker. You must speak to a monetary adviser concerning your demands and objectives prior to you purchase an annuity.

2 Million Dollar Annuity

The distinction in between the 2 is when annuity repayments start. You don't have to pay taxes on your profits, or payments if your annuity is an individual retirement account (INDIVIDUAL RETIREMENT ACCOUNT), till you withdraw the earnings.

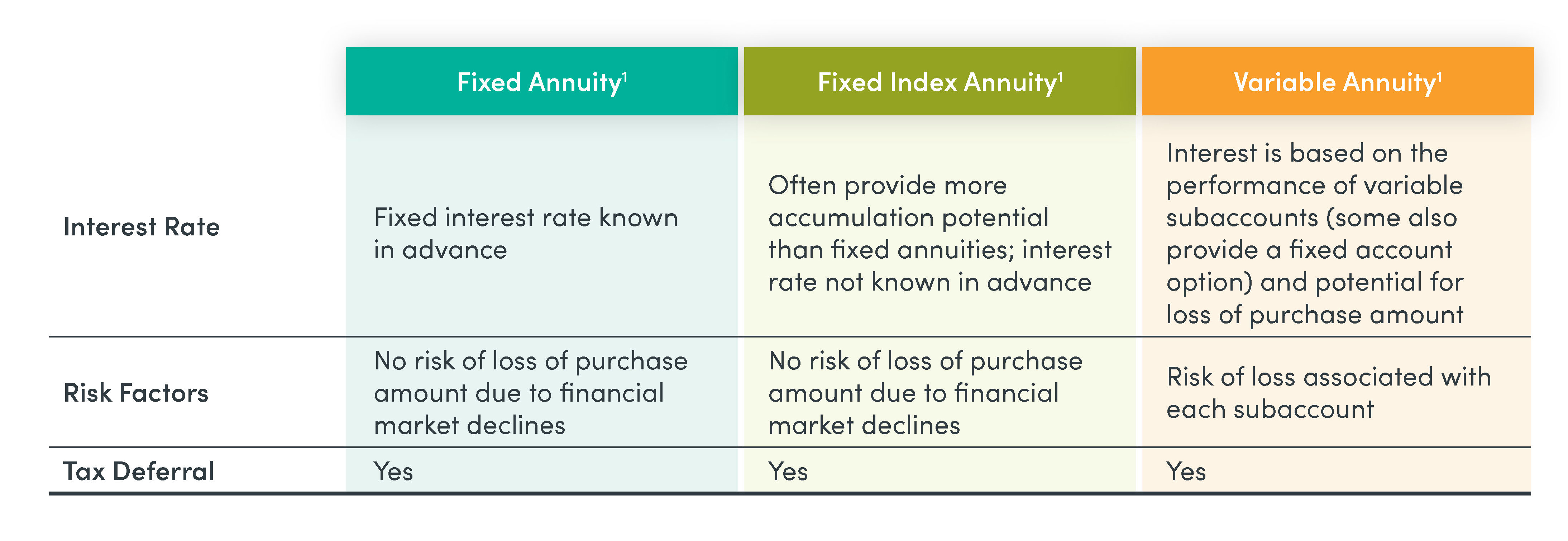

Deferred and instant annuities offer a number of alternatives you can select from. The alternatives offer various degrees of possible danger and return: are assured to make a minimal passion price.

enable you to select in between sub accounts that resemble common funds. You can earn extra, but there isn't an ensured return. Variable annuities are greater threat due to the fact that there's a possibility you might lose some or every one of your cash. Set annuities aren't as high-risk as variable annuities due to the fact that the financial investment risk is with the insurance policy firm, not you.

Annuity Retirement Plan

Set annuities guarantee a minimal passion rate, generally in between 1% and 3%. The firm might pay a greater interest price than the assured interest price.

Index-linked annuities show gains or losses based upon returns in indexes. Index-linked annuities are more intricate than dealt with deferred annuities. It's essential that you understand the features of the annuity you're thinking about and what they imply. Both contractual attributes that influence the amount of rate of interest credited to an index-linked annuity one of the most are the indexing method and the engagement price.

Each counts on the index term, which is when the firm determines the passion and credits it to your annuity. The identifies just how much of the boost in the index will be used to calculate the index-linked rate of interest. Various other crucial functions of indexed annuities consist of: Some annuities top the index-linked rate of interest price.

The floor is the minimal index-linked rates of interest you will certainly make. Not all annuities have a floor. All fixed annuities have a minimal surefire worth. Some business utilize the standard of an index's worth as opposed to the worth of the index on a specified day. The index averaging may occur any type of time throughout the regard to the annuity.

The index-linked passion is included in your initial premium quantity however doesn't compound throughout the term. Various other annuities pay substance passion throughout a term. Substance rate of interest is interest gained on the money you conserved and the rate of interest you make. This suggests that interest already credited likewise earns passion. In either instance, the passion made in one term is usually worsened in the next.

Buying Annuity With 401k

This percentage could be used as opposed to or in addition to an involvement rate. If you get all your money prior to the end of the term, some annuities will not credit the index-linked interest. Some annuities could credit just component of the passion. The percent vested generally raises as the term nears the end and is constantly 100% at the end of the term.

This is since you birth the investment threat instead of the insurance provider. Your representative or financial advisor can help you decide whether a variable annuity is appropriate for you. The Stocks and Exchange Payment classifies variable annuities as safeties due to the fact that the performance is stemmed from stocks, bonds, and various other investments.

Distribution Annuity

An annuity agreement has two stages: an accumulation phase and a payout phase. You have numerous options on just how you contribute to an annuity, depending on the annuity you purchase: enable you to pick the time and amount of the repayment.

:max_bytes(150000):strip_icc()/annuity-ladder.asp-final-bb1e6602acd2498ead56e5f8bcb458c3.png)

enable you to make the same settlement at the same period, either monthly, quarterly, or annually. The Irs (IRS) controls the tax of annuities. The internal revenue service enables you to delay the tax on earnings until you withdraw them. If you withdraw your earnings before age 59, you will possibly have to pay a 10% early withdrawal charge in enhancement to the tax obligations you owe on the interest gained.

After the accumulation phase ends, an annuity enters its payment stage. There are numerous options for getting payments from your annuity: Your company pays you a fixed quantity for the time specified in the contract.

Several annuities bill a charge if you withdraw money before the payment phase. This penalty, called an abandonment fee, is generally highest in the very early years of the annuity. The fee is typically a percent of the taken out money, and usually begins at about 10% and goes down yearly up until the abandonment period is over.

Table of Contents

Latest Posts

Breaking Down Fixed Vs Variable Annuity Pros Cons A Closer Look at Fixed Income Annuity Vs Variable Growth Annuity Defining the Right Financial Strategy Pros and Cons of Variable Annuity Vs Fixed Annu

Highlighting Fixed Income Annuity Vs Variable Annuity A Closer Look at How Retirement Planning Works Breaking Down the Basics of Fixed Index Annuity Vs Variable Annuity Advantages and Disadvantages of

Variable Annuity Guaranteed Minimum Income Benefit

More